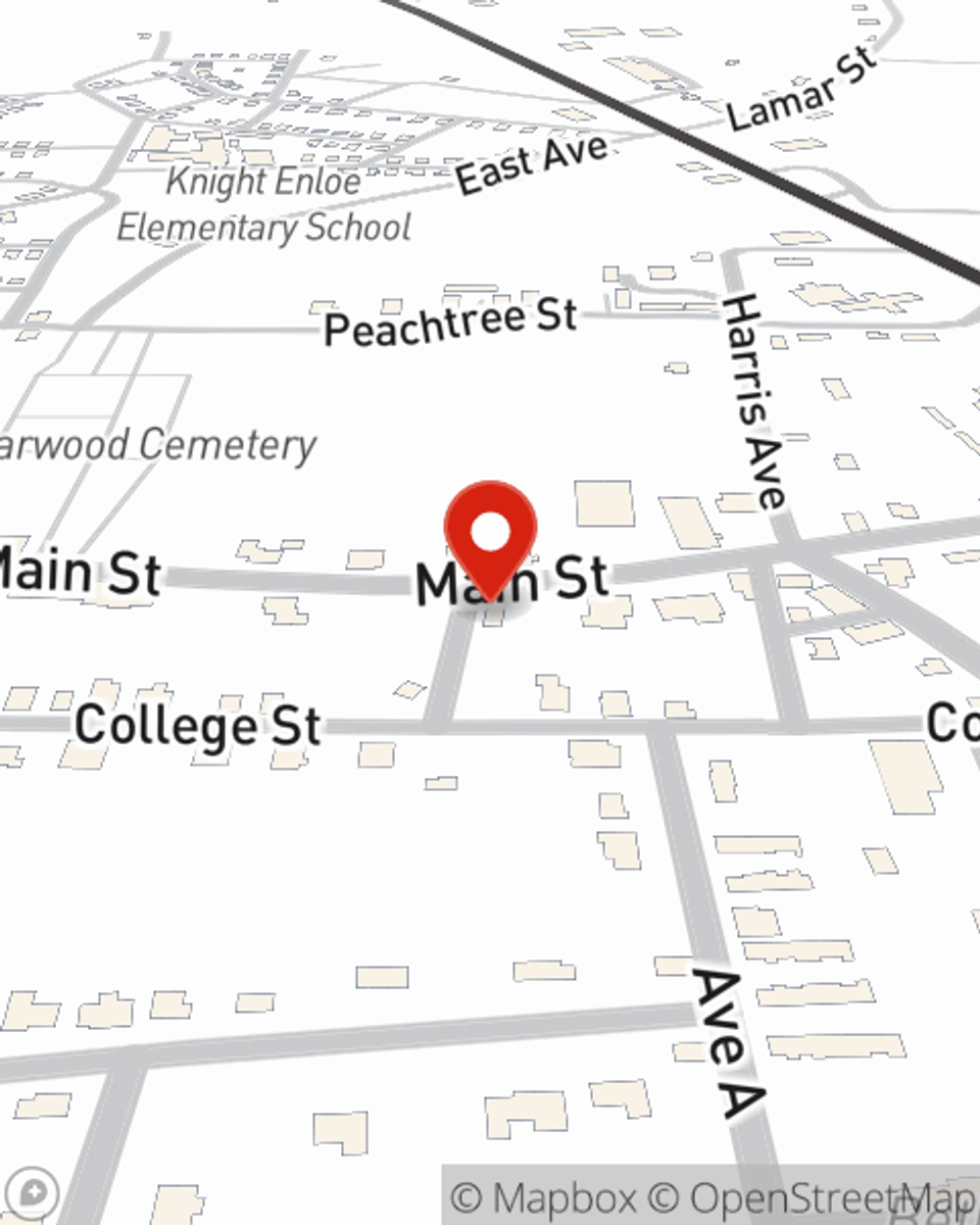

Insurance in and around Roanoke

Need insurance? We got you.

Cover what's most important

Would you like to create a personalized quote?

- INSURANCE AUTO

- /insurance/auto

A Personal Price Plan® That’s Uniquely You

Everyone loves saving money. Personalize a coverage plan that helps protect what’s important to you – family, things and your bottom line. From safe driving rewards, bundling options and discounts*, you can create a solution that’s right for you. Contact Ken Seiffert for a Personalized Price Plan.

Need insurance? We got you.

Cover what's most important

Our Broad Range Of Insurance Options Are Outstanding

Want to know why State Farm is the largest insurer of automobiles and homes in the U.S.? Great insurance coverage options, competitive prices, easy claims and excellent service might have a lot to do with it. Or maybe you're looking to help secure your family's financial future. Let us help you ease that burden. The unmatched strength of State Farm Life Insurance, a wide range of products and Personalized Price Plans; it's a great value and smart choice.

Simple Insights®

What is telematics and how is it used?

What is telematics and how is it used?

Learn what telematics means, how driving data like speed and mileage is collected via devices or apps and how it's used in usage-based auto insurance programs.

Maintaining a historic home

Maintaining a historic home

With a historic home, completing these home maintenance tasks a little bit at a time could improve the overall resale value of your home.

Ken Seiffert

State Farm® Insurance AgentSimple Insights®

What is telematics and how is it used?

What is telematics and how is it used?

Learn what telematics means, how driving data like speed and mileage is collected via devices or apps and how it's used in usage-based auto insurance programs.

Maintaining a historic home

Maintaining a historic home

With a historic home, completing these home maintenance tasks a little bit at a time could improve the overall resale value of your home.